What trends are in store for beer in 2022? Let's take a look at some of the larger shifts happening in the beer market and see how those trends are showing up in restaurants and bars.

Customers want low and high alcohol beers

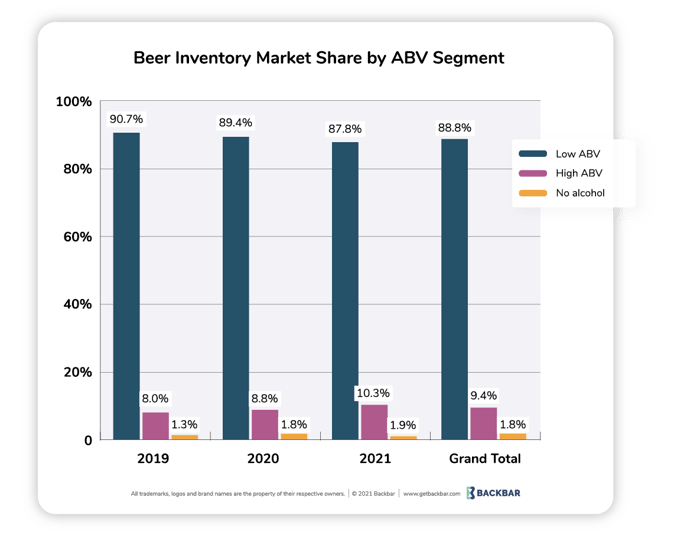

Over the past few years low-ABV and no-ABV drinks have become more popular. The turn towards lighter drinks has been chalked up to (younger) consumers being more health-conscious and choosing hangover free mornings over late night buzzes.

And while low-ABV drinks are still growing in popularity, the beer market is seeing strong growth in high alcohol beers clocking above 6% and 7%.

Craft brewers have already tapped into the low-ABV trend by offering lighter options like session-IPAs that weigh in around 4-5% ABV. Traditionally lower-ABV beer styles like Gose and craft lagers have also become more popular and will continue to grow in 2022.

But this past year we've also seen a big increase in inventory market share of higher alcohol beers, while growth has slowed or reversed for beers in the 4-5% range.

Double IPAs continue to grow

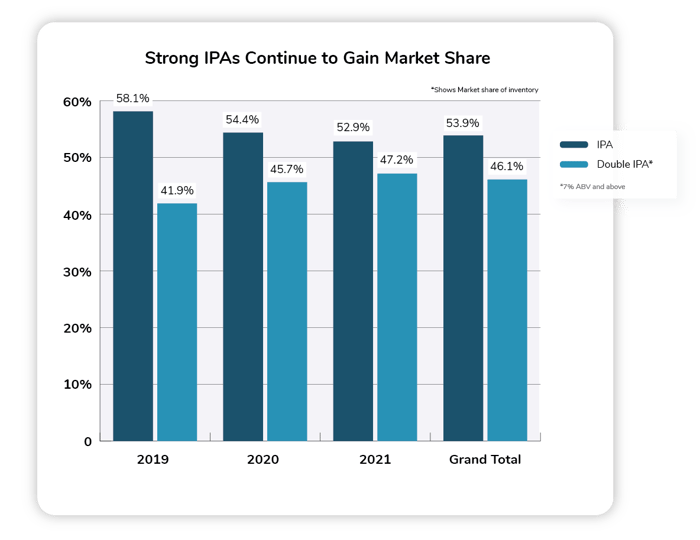

The Brewer's Association 2021 Midyear State of the Craft Brewing Industry Update

noted that that the IPA category growth is slowing down, but Double IPAs were growing and helping the category overall.

Backbar has thousands of bar and restaurants using our platform to manage beverage inventory, so we looked at our own inventory data to see if the on-premise restaurant and bar segment is experiencing the same Double IPA trend as the general beer market.

Backbar inventory product share data shows Double IPAs have been growing steadily since 2019 and are nearly equaling regular IPAs for total inventory market share.

It looks like craft beer drinkers are more and more likely to order high ABV selections, especially when looking at IPAs. Double IPAs should continue to grow in 2022.

American Lite Beers Losing Market Share

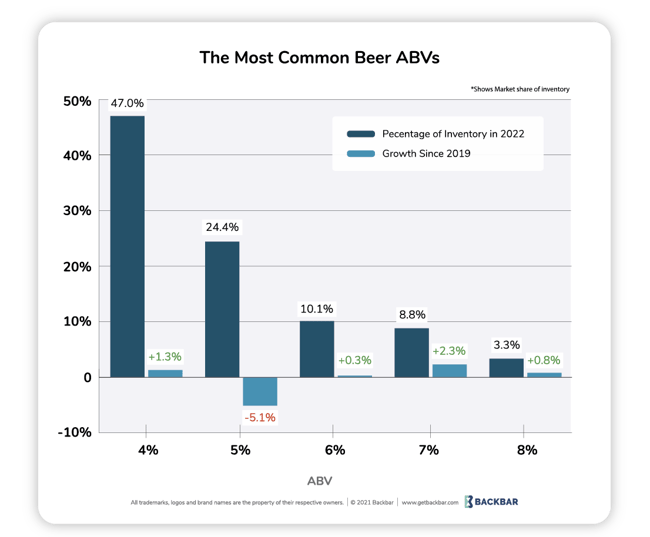

We also wanted to see overall inventory market share of beer by ABV to see if the trend for stronger beers was category wide or just being experienced within the IPA segment. Our inventory data shows that since 2019, beers in the 7% range have grown by 2.30%. Beers at 8% have also grown by .8% in 2021.

Beers in the 4% range, which includes major domestic light beers like Miller Lite, Bud Light, and Coors Light (all three are listed at 4.2% ABV) have fallen by over 5% in that same time period.

Backbar inventory data shows the American Lite (includes Bud Light and Coors Light) beer category as a whole has fallen by 2.77% since 2019, showing that restaurants and bars are diversifying their beer offerings.

Beers in the 5% range hold the biggest inventory market share and grew their market share by 1.3% over that same period but showed no growth from 2020 to 2021.

Hard Seltzer is replacing Hard Cider

A few years ago, hard ciders had a moment as the next-big-thing in the beer (or beer-adjacent) space, but it looks their buzz has been squashed by the now-big-thing, (also beer-adjacent) Hard Seltzer.

Cider had been seen as a great alternative and lighter option than beer but it seems seltzer has taken over that role for drinkers.

While the seltzer boom didn't happen behind the bar but on the shelves of retail stores, hard seltzer has still grown in the on-premise space and looks primed to continue growing.

Seltzer overtook cider in on-premise inventory share in 2020, and that trend will continue into 2022. Hard Seltzer holds 5.9% of inventory market share for beer while Cider dropped from 5.2% in 2019 to 3.7% in 2021.

Look for the hard cider category to consolidate and trim down offerings with category becoming more dominated by the top brands.

Pucker up for sour beers

Citrus flavors are quite popular in the hard seltzer segment and tart beer styles like Wild Ales and Berliner Weisse are also growing as fan favorites for beer drinks.

While both styles make up less than 1% of the inventory share in our data, they have grown significantly in the lambic and sour segment.

Wild Ale has gain 5.6% of lambic and sour beer market share since 2019, while Berliner Weisse has gained 5.1%.

This growth certainly doesn't indicate a sour beer boom but it does highlight a consumer flavor preference that is increasingly favoring the sour/sweet combination of tropical and citrus fruits found in the most popular seltzer and RTD drinks in growing brands like High Noon.