You might have it all going for you—a great staff, an acclaimed food and beverage menu, and an instagram worthy atmosphere. But have you checked the books lately?

Restaurateurs get so caught up in the details, sometimes they overlook their financial situation. Yes, those new bistro chairs you got for the patio are super cute, but what did it cost you?

The most important aspect of running a successful business is understanding your restaurant finances.

The restaurants that survive long-term have effective strategies for managing money and protecting their bottom line.

Today, we will discuss these important aspects of your restaurant finances:

- Maintaining your cash flow

- Lowering your expenses

- Understanding your costs

- Forecasting your future sales with POS data

Maximizing Your Cash Flow

The most basic thing any manager or owner needs to understand is cash flow. Ever heard the saying, "cash flow is king?" There's a reason that saying exists—managing your cash flow is essential for running a successful enterprise.

What is Cash Flow?

In its most basic sense, cash flow is the movement of cash in and out of your restaurant. Ideally, you want more cash coming in than you want going out (obviously). You should know exactly how much is coming and going to have an understanding on where your finances stand.

To figure out your cash flow, you will subtract your cash in minus your cash out.

Cash In - Cash Out = Cash Flow.

Let's say for the month of August you bring in $100,000. For the same set time period, you spent $25,000 on operating costs. Your cash flow for the month of August is $75,000.

The problem with some restaurants is that they don't have enough cash coming in to account for surprise expenses. You may think you're in the green—then all of a sudden, a dishwasher breaks, the roof starts leaking, or your walk-in cooler stops working. Do you have the cash flow to fix it?

Replacing restaurant equipment can cost you thousands of dollars. You always need cash on hand for any surprises that might come up. It's important to be able to fix issues right away, so you can keep your doors open and have that cash flow coming in.

Ways to Improve Your Cash Flow:

- Keep your inventory low. Tying up your cash in excess inventory is money sitting on the shelves. Over ordering, or having too many items on your menu, can be detrimental to your cash flow.

- Focus on alcohol sales. Alcohol has the highest profit margins, and if you're selling a lot of it, you'll generate bigger cash flows. Our drink cost calculator can help you accurately price your drinks for maximum profit.

- Use POS data to track sales trends. It will help you plan ahead for staffing, food and beverage needs, etc. This will help you keep your payroll and food costs low.

- Map your projected sales vs. the bills you need to pay that week. Are you looking tight, or do you have some wiggle room? Thinking ahead can mitigate disaster before it strikes.

Restaurant Cost Breakdown

What are the typical costs that restaurants and bars have to account for?

No matter what kind of restaurant you are, food and labor will make up the highest percentage of your costs. Keeping them in check is critical for your success.

No matter what kind of restaurant you are, food and labor will make up the highest percentage of your costs. Keeping them in check is critical for your success.

Let's get into a detailed breakdown of restaurant costs so you can see exactly where your money is going (and why).

Food Costs

Your food cost is how much money you make on your food, versus how much money you have to spend to make the food. Calculating your food cost is tedious, but it's necessary to ensure that your restaurant is profitable.

You can calculate your individual plate cost, but honestly, it's a bit time consuming (and not always the most accurate, as it doesn't account for your sitting inventory). We recommend you look at the bigger picture here.

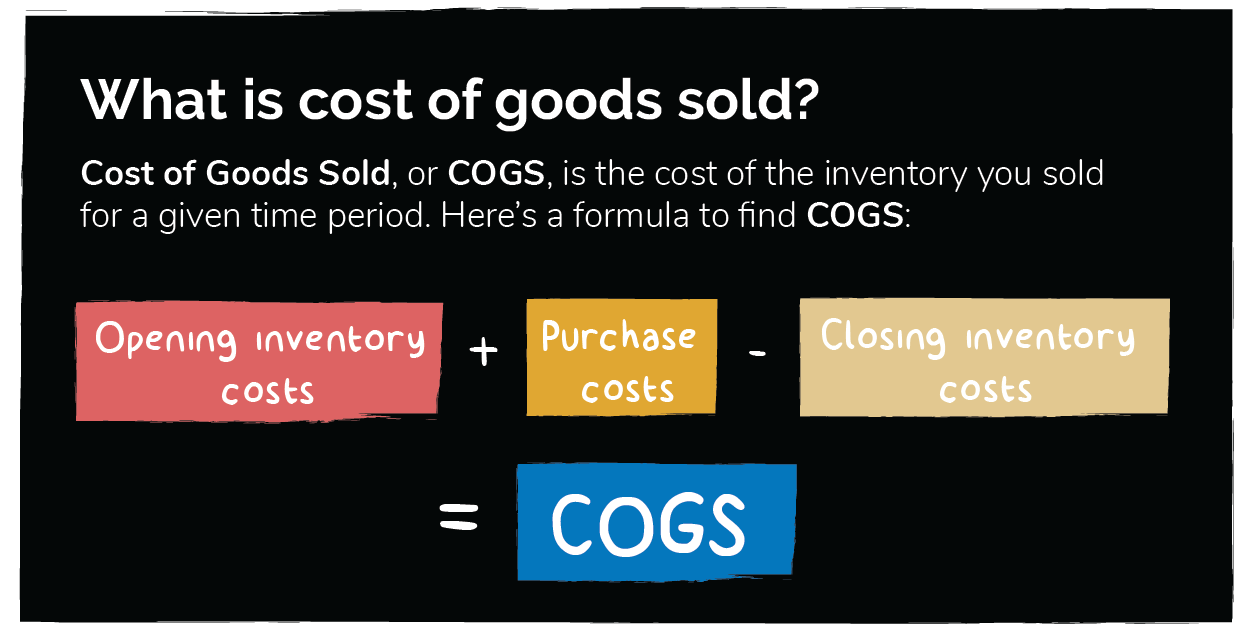

Remember our old friend, Cost of Goods Sold (COGS)?

Finding your COGS will help you find an accurate overall food cost percentage.

First, choose a set time period you want to calculate (whether it's for the entire month, or a certain week). You'll use this formula to get your food cost:

COGS ÷ Total Sales = Food Cost

Keep in mind—depending on the type of restaurant you run, your food costs are going vary. A fine dining restaurant is naturally going to spend more on their food than a fast casual restaurant. There is no magic number for what your percentage should be, but it typically hovers in the range of 30-35% for most restaurants.

Costing your food accurately adds money to your bottom line. Toast offers a free food cost calculator to get you started—they even take into account the type of concept you're working with, so you can get a more accurate percentage.

How to Reduce Food Costs:

- Cut menu items that aren't selling. You're wasting money on inventory that isn't profitable. A smaller menu simplifies the ordering process, and sticking to your fan favorites will boost your cash flow.

- Make sure your inventory is versatile. All of your ingredients should do double duty. Make sure you can use your inventory across different dishes and in different ways.

- Don't over order. It will go bad eventually, and you're tying up cash in your inventory (which is a big mistake). Only order what you need.

- Reduce your waste. This also ties in with over ordering, but reducing waste begins and ends with your BOH staff. Ensure they're following the first in, first out (FIFO) rule, and try to use food scraps in new ways before composting.

How to Manage Labor Costs

You're nothing without a great staff; but it's also going to cost you.

As with food costs, your labor costs will vary depending on the type of restaurant you're running, but they tend to hover around 25-30%. Calculating your labor cost will tell you if there's an issue getting out of control, or if you've finally hit the sweet spot.

Your labor costs are more than just the hourly wages of your staff or manager salaries—it includes everything related to your employees that you pay for. When calculating your labor cost, be sure to include the following:

- Hourly wages

- Manager salaries

- Health insurance

- Vacation days

- Sick days

- Taxes

- Bonus pay

- Overtime

- Shift meals

Your total labor costs are going to be the sum of everything above. Yikes! No wonder labor is so expensive—however, your staff is the most important investment you'll ever make, so it's worth it.

How to Calculate Labor Cost Percentage

Let's say for the month of August, your labor costs total $100,000. For the same time period, your gross sales are $400,000. Divide your labor cost by your gross sales, and then multiply by 100. That's your percentage.

In this case, your labor percentage is 25%. Not bad!

How to Reduce Labor Costs:

- Don't overstaff. Staffing too many people is costly to your payroll, and it makes it difficult for your servers to make tips. Staff appropriately (again, use POS data to gauge your staffing needs).

- Work on increasing retention. It costs you big time every time someone leaves your establishment. Work on retention, and it'll save you with hiring/turnover costs.

- Cross-train your employees. Cross-training is what will allow you to staff lighter and staff smarter. Make sure your employees can effectively do multiple jobs. This will also reduce knowledge gaps in your staff.

Prime Cost Calculator

Before we get to discussing other restaurant costs, we need to cover prime costs (because they include both your labor costs and your food costs).

Prime costs are important to know because they are a key indicator of how your restaurant is performing.

In order to calculate prime costs, you will use this formula:

COGS + Labor Costs = Prime Cost.

Now, you can divide your prime cost by your sales, and you'll get your prime cost as a percentage of your sales.

Prime Cost ÷ Total Sales = Prime Cost Percentage

On average, you should try to keep your prime costs below 60%.

Since prime costs are an indicator of success, you should try to check your prime costs on a weekly basis. But don't fret if you see discrepancies in your numbers—prime costs will fluctuate, no matter how well you streamline your service and inventory.

Knowing where you stand is half the battle. It will help you make changes as you go, and spot inefficiencies before they begin to impact your bottom line.

Other Helpful Cost Guides From Backbar:

The Other Costs You Need to Keep in Check (Yes, There's More)

If you think we're done discussing costs, think again. Food and labor are the two big ones, but there's a lot of other costs you need to account for every month:

- Utilities. Gas, electric, water, wifi, etc. The general consensus is that your utilities should not be more than 5% of your sales.

- Rent. Rent prices vary wildly based on your location; the number that's comfortable for you depends on your sales. Generally, you can expect to set aside 5-8% of your sales on rent.

- Marketing. The magic isn't going to happen on its own. Marketing is a necessity to get people excited about your restaurant, and keep them coming. The marketing budget should be 3-6% of your sales.

- Maintenance. Things are going to break now and then. The National Restaurant Association estimates maintenance costs will be about 1.5% of your sales.

Some of these costs can be managed more easily than others; they fall under the umbrella of either fixed costs or variable costs.

Restaurant Fixed Costs

Fixed costs are costs that don't tend to fluctuate (hence, the term "fixed" costs). These are easier to predict because they are not tied to your sales, so you can generally count on them being the same each month.

Your fixed costs include things like your rent, insurance, and loan payments. The trickier thing to manage are your variable costs. Variable costs would be things like utilities, food and beverage, and hourly wages for staff. These costs do depend on your sales, so they can be difficult to predict.

It's important to note that your variable costs can change due to the seasonality of your restaurant. If you have a patio that gets busy in the summer, you're going to have to hire more staff, which will increase the amount you pay out for hourly wages. You'll also probably be spending more on your inventory and utilities.

Although these costs do vary, by keeping a log and looking at POS data, you can more accurately gauge what they will be.

Inventory Management is the Key to Keeping Costs Low

If you want to save money (and let's be real—you do), accurately managing your inventory is going to get you where you need to be financially.

Backbar is here to nudge you in the right direction. Our analytics will show you how your inventory is performing, optimal drink pricing for maximum profits, and where you can make cuts to increase efficiency.

If you want to get to know us, feel free to try us out for a 6 month free trial. You have nothing to lose (except for some excess inventory).